Banking should not be the exclusive domain of the private sector, as discredited neoliberal ideology demands, but should be available to the government, so that the power of banking to create credit can be harnessed and directed for the long-term investment needs of the nation.

Download PDF of COMMONWEALTH NATIONAL CREDIT BANK BILL 2019 - the draft legislation for Australia’s New Commonwealth National Credit Bank.

The private financial sector, even a well-functioning one, will prioritise profit in lending decisions, but the government needs to be able to invest in long-term infrastructure projects that don’t make a profit, but increase productivity from which the nation profits. Instead of making such investment out of annual revenue, a national bank enables the government to use public credit and not have to borrow from overseas.

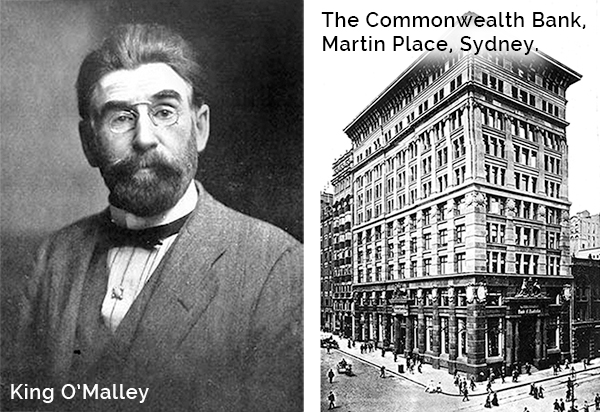

Remember the Commonwealth Bank, before the Hawke/Keating ALP sold it? It was the “people’s bank”, which served the people, and was owned by the people. The centrepiece of the urgently-required reorganisation of the financial system will be the establishment of a new people’s bank, a Commonwealth Bank-style, government-owned national bank.

Whereas Glass-Steagall is an emergency protectionist measure, to erect a firewall between the imploding financial system and the people, so they keep their savings, the Citizens Party's Commonwealth National Credit Bank Bill will facilitate the next step, which is the reconstruction of the economy, and the creation of a new financial system, in a way that furthers the common good of the people.

The policy of banking for the common good was the vision of the “old” Labor Party of King O’Malley, Frank Anstey, Jack Lang and John Curtin, which was initially realised through the 1911 establishment of the Commonwealth Bank. In its first years of operation during WWI, under the governorship of Sir Dennison Miller, the Commonwealth Bank: forced the private banks, through competition, to lower their fees; then it “saved” those same banks by averting a “run” on the private banking system; and financed many important war-related measures.

Sadly, with the untimely death of Governor Miller in 1920, private financial interests directed Tory Prime Minister Stanley Melbourne Bruce to hand over control of the bank to private bankers, and strip it of essential powers, so that it never functioned as effectively again. Save for the brief period of WWII, when John Curtin and Ben Chifley empowered the Commonwealth Bank to regulate and direct the entire national banking system for the war effort, the function of the Commonwealth Bank was systematically eroded over the decades. It lost its reserve banking powers in 1959, which put its central banking function under private control, and was eventually reduced to a simple, government-owned savings bank, before it was privatised in three tranches from 1991 to 1996. However, even as a simple savings bank, its role was essential: it guaranteed every depositor’s savings (which guarantee was lost once it was privatised) and it kept the private banks’ fees low, by forcing them to compete. Once it was privatised in 1996, the big four banks went on a profit spree by hiking fees and slashing staff and branches, and gouging over $80 billion in profits in ten years!

It is time for a new national bank with all the powers to regulate and direct the national economy.

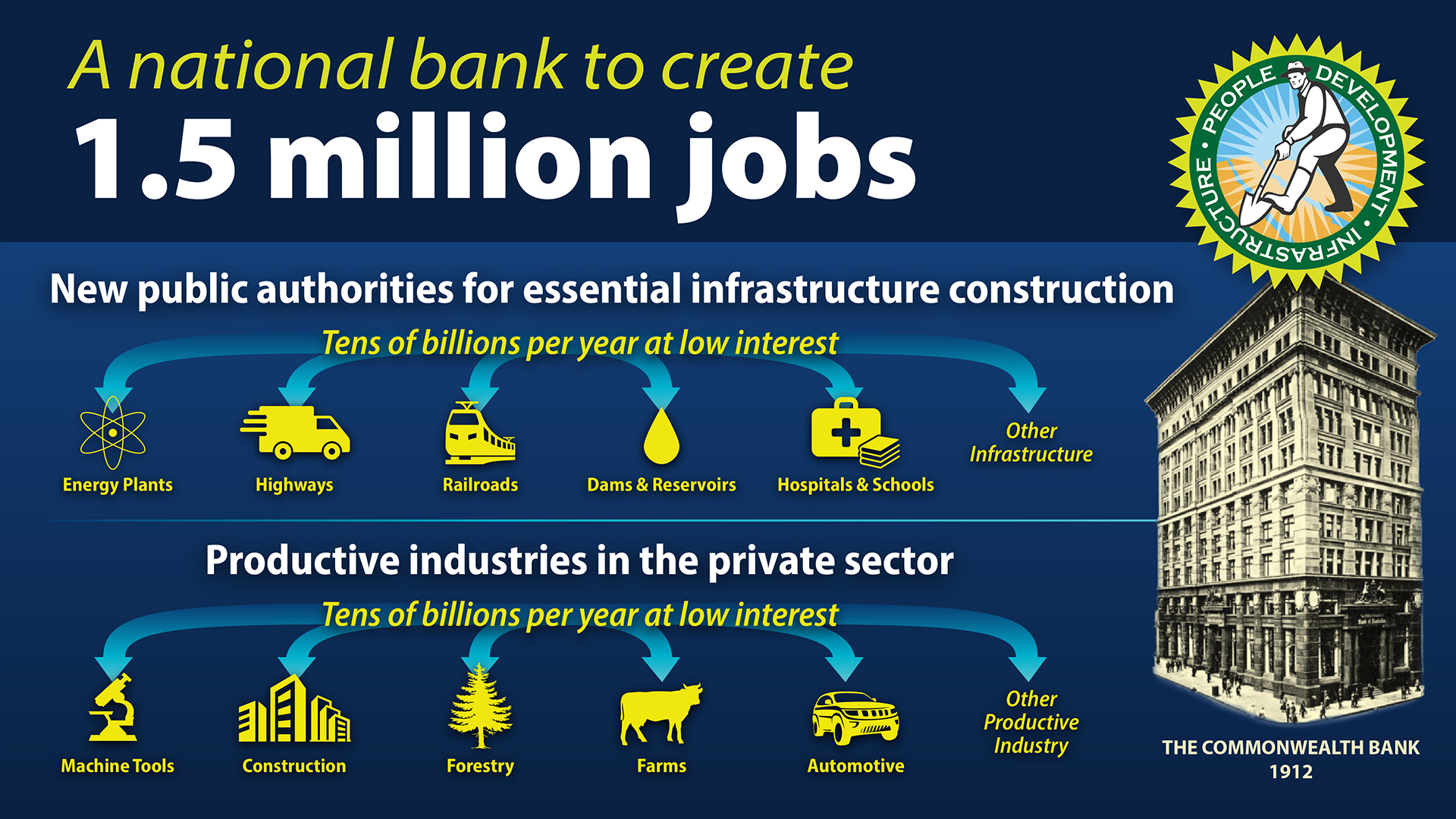

The Citizens Party is currently refining legislation to establish a Commonwealth National Credit Bank (CNCB), which can extend credit to the government for investment in public infrastructure projects that will reindustrialise Australia and create jobs; and for credit assistance to family farmers, manufacturing entrepreneurs and small businesses, who just need a fair go but have been starved of credit by the private banks. The CNCB will also regulate the private banks, guarantee the deposits of the commercial banks (as opposed to the speculative investment banks), conduct an in-depth, honest audit of all Australian banks—which neither APRA nor anyone else has done at present—and reorganise and save any which are not hopelessly bankrupt. It will help to save Australians’ retirement savings locked up in superannuation funds, which as things now stand will be at risk in a crash. Superannuation funds will be able to invest in debentures (special bonds) issued by the national bank for a guaranteed return, thereby investing in Australia’s economic future.

Read Why Australia urgently needs a national bank

Read Frequently Asked Questions on the National Infrastructure Bank (NIB), by Alphecca Muttardy, Macro-economist, in relations to the Coalition for the National Infrastructure Bank (NIB) in the United States. (Last Updated: September 6, 2019)

COMMONWEALTH NATIONAL CREDIT BANK BILL 2019

An Act to overturn the current monetarist philosophies and policies and return Australia to a public credit-based system implemented through a system of national banking, to establish a new, government-owned national bank to regulate Australia’s national credit, to thereby re-establish public confidence in the banking system, to restore to the Australian Parliament the Constitutional power to regulate Australia’s currency and credit, re-enforcing the Constitutional obligation of the Commonwealth to regulate the Australian economy which requires the Commonwealth government to ensure an orderly flow of credit and currency to public and private enterprise engaged in the production and transportation of tangible economic wealth, including manufacturing, agriculture, construction, mining, public utilities and transportation and enable the financing of nationwide infrastructure projects in water, high-speed rail, and energy among other vital aspects of the economy, to act as science-drivers and to increase Australia’s physical-economic productivity and therefore the standard of living of all Australians.

A few features of the legislation

The CNCB establishes a Bank which is responsible to Parliament, instead of to the private individuals who currently run the Reserve Bank, and mandates, by law, the Bank to function in such a manner as to cause a rise in Australia’s “potential population-density” through a “rise in the physical output of the nation” and in “the rate of introduction of new technologies into the economy.” Precise measures to calculate such rises are specified, so that the Bank has no choice, but to so function, or an investigation is mandated.

All new credit creation by the new Bank shall, by the terms of this Bill, be tied to tangible hard commodity production. The present Reserve Bank’s ability to create or extinguish credit by “open market operations”—is expressly forbidden.

The “powers” of the proposed new Bank are greater than those of the existing Reserve Bank, and in addition to those of the Reserve Bank, include power:

- to issue notes and establish credits to acquire, support and retain the sovereignty of Australia and for the defence of the lives, liberty, and happiness of the Australian people:

- to control, and if necessary, prohibit, the movement and dealing in currency, of foreign exchange and financial instruments of the widest definition;

- to plan, measure, and map the economic state of the nation;

- to provide credits under a National Emergency Credit Issue Act to guarantee up to $100,000 per individual person, the deposits of such persons in the event of a financial collapse of a substantial percentage of the existing trading banks. The confusing claim that the Reserve Bank, under the Reserve Bank Act 1959, has preference over depositors in the event of bank failure, when Section 16 of the Banking Act 1959 states that, priority in the event of bank failure lies with the depositors, has been corrected in Section 55 of the CNCB Bill.

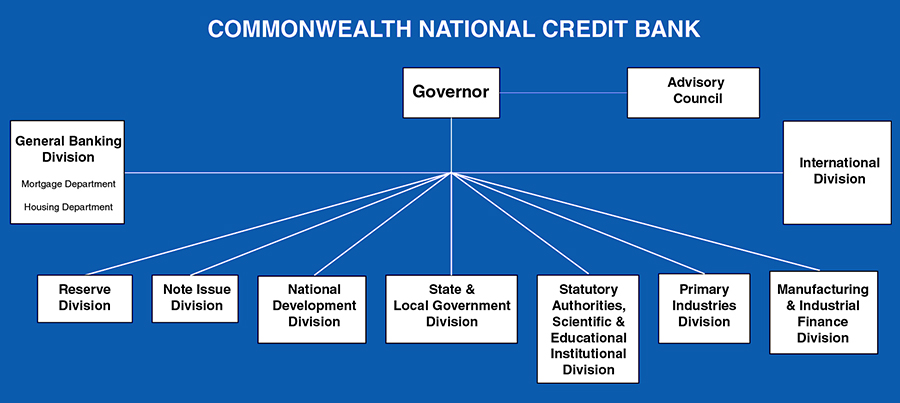

The new Bank will have eight divisions, as follows:

- The Reserve Division, responsible to licence, supervise, and regulate all financial institutions.

- The Mint and Note Division, responsible for the issuance of legal tender, i.e. notes and coins.

- The National Development Division, responsible to assess the nation’s need for credit to provide for the establishment and maintenance of infrastructure of national importance and to provide such credit.

- The Statutory Authorities, Scientific and Educational Institutions Division, responsible to assess the nation’s need for credit to provide for the capital costs of land, buildings, plant, machinery, and tangible items, as well as for scientific and technological research and development costs for statutory authorities, scientific and educational institutions, and to provide such credit.

- The State and Local Government Division, responsible for assessing the nation’s needs for credit for the establishment and maintenance of infrastructure not specifically provided for by other divisions of the bank and to provide that credit at an annual interest rate not to exceed three per cent.

- The Primary Industries Division, responsible for assessing the nation’s need for credit and the issuance of credit expressly for family farmers and other family producers of primary products who directly contribute to increasing the potential population-density of Australia.

- The Manufacturing Division, responsible for assessing the nation’s need for credit and the issuance of credit for manufacturing industries of Australia.

- The International Division, responsible for the administration of exchange controls, and provisions of the Act relating to gold, and if and when required, the exchange and clearance of financial instruments and other international matters.

The existing informal regulation of trading banks has been formalised, and provisions have been included to stop banks and other financial institutions from engaging in or financing speculative activities relating to currency, foreign exchange. derivatives, and the like.

All activities of the CNCB are to be open for public scrutiny and statements of account and activities are to be laid before the Parliament within 30 days of the close of each calendar month.

Download PDF of COMMONWEALTH NATIONAL CREDIT BANK BILL 2019 - the draft legislation for Australia’s New Commonwealth National Credit Bank.